Updapt | ESG Reporting Software For Real Estate Portfolio and Investors.

ESG Reporting Software For Sustainable Real Estate:

The growing necessity of ESG in various industries which includes real estate is quite prevalent.

Investors, stakeholders and financial firms are seeking out organizations with potential ESG practices while comprehending the importance of ESG at the same time.

Most of the real estate entities are struggling to adopt ESG practices in a structured manner and on the other hand, speaking about the ESG data tracking, the difficulty to collect various information for measuring the ESG performance of organizations has been duly noted.

The real estate industry is tangled between the difficulties of data management and reporting.

Hence, we are here to facilitate these complexities through the best ESG reporting software for the real estate. It is delicately designed for real estate industries, real estate professionals, real estate investors as well as real estate companies.

In this article, we break down and cover each element of which sustainability software is best for real estate and which ESG software provides free options and software pricing in 2024.

Know More About : Machine Learning & Predictive Analytics

ESG In Real Estate:

In the contemporary world, we continue to face diverse environmental issues like climate change, water scarcity, famine, and global warming.

Based on the World Green Building Council, buildings produce 40 percent of the total carbon emission across the world.

Therefore, commercial real estate industries address those issues and create long term ESG strategies to reduce their carbon emissions.

Environmental and social concerns are significant in the real estate industry. Environmental concerns cover the material concerns like building materials expose some amount of emissions and create harm to our ecological system. Social factors imply social responsibilities such as well being, productivity, and conditions of the workplace.

For the requirement of net zero emission and creation of an ecological friendly environment, the real estate industry entered into the ESG domain. It ensures buildings are constructed with sustainable material along with renewable energy sources.

ESG software for commercial real estate:

There are numerous certifications required while implementing sustainability for commercial real estate such as LEED, CMCP, etc.

Measuring the energy consumption is the challenge in sustainability of commercial real estate. The assortment of sustainability data is quite complex. But, as for our ESG Software, it facilitates data management processes and simplifies sustainability reporting processes.

Users can collect various data from a number of sources and consolidate that at one place such as energy consumption, waste production and more. Furthermore, users can create effective ESG strategies as well.

Next thing is data tracking. Through our ESG software for commercial real estate users can track various ESG indicators such as water consumption, waste management, water management, and green gas emissions.

Therefore, without any hurdles; those who wish to incorporate sustainability, especially commercial real estate portfolios should choose the right real estate ESG software.

Top Six Reasons Why Updapt is the Best ESG Reporting Software For Sustainable Real Estate Portfolio:

Data Management:

Are you still using excel sheets to manage ESG data? Do you feel inconvenient while remembering excel formulas to align ESG data on excel? Would you like to streamline the diversity of ESG data with just a single click? Updapt data management software mends all these data related flaws.

Moreover, Updapt has

- Streamline and consolidated ESG data at one place.

- Easy integration to other platforms.

Reporting with Frameworks:

Do you think data has a lot to do with reporting? Yes, if you want to enhance ESG reporting, data is the primary chil. For that, Updapt provides data management with reporting features. Reporting always bestows a clarified picture about the company's sustainability performance.

Do you expect the features listed below for your real estate organizations?

- Reporting Visualization and data automation.

- Compliance tracking.

- Reduced reporting time.

- Comparison of the sustainability performance along with industry average.

- Demonstrate your ESG performance to investors and stakeholders.

- Customized sustainability reports based on small, medium and enterprise real estate organizations.

- Customized sustainability report for real estate investors.

- Scope-1, scope-2 and scope-3 reporting.

Yes, Updapt has numerous features. Therefore, we provide sustainability reporting in a 360 degree overview.

Frameworks:

Those whose real estate organizations fail to choose appropriate frameworks they are facing difficulty in measuring their ESG Performance. Moreover, there are many frameworks in Updapt to choose from.

Those are:

- Global Reporting Initiative frameworks.

- Corporate Sustainability Reporting Directive frameworks.

- Business Responsibility and Sustainability Reporting frameworks.

- Task Force on Climate-Related Financial Disclosures frameworks.

- European Sustainability Reporting Standards frameworks.

Analysis of the ESG Performance:

- Do you want advance prediction of the risk before it occurs?

- Have you heard about features of prioritizing ESG issues?

- Timely identification of the ESG issues?

If your answer to these questions is a big yes then the Updapt sustainability software is the right fit for you in the analytics area.

Emission Management:

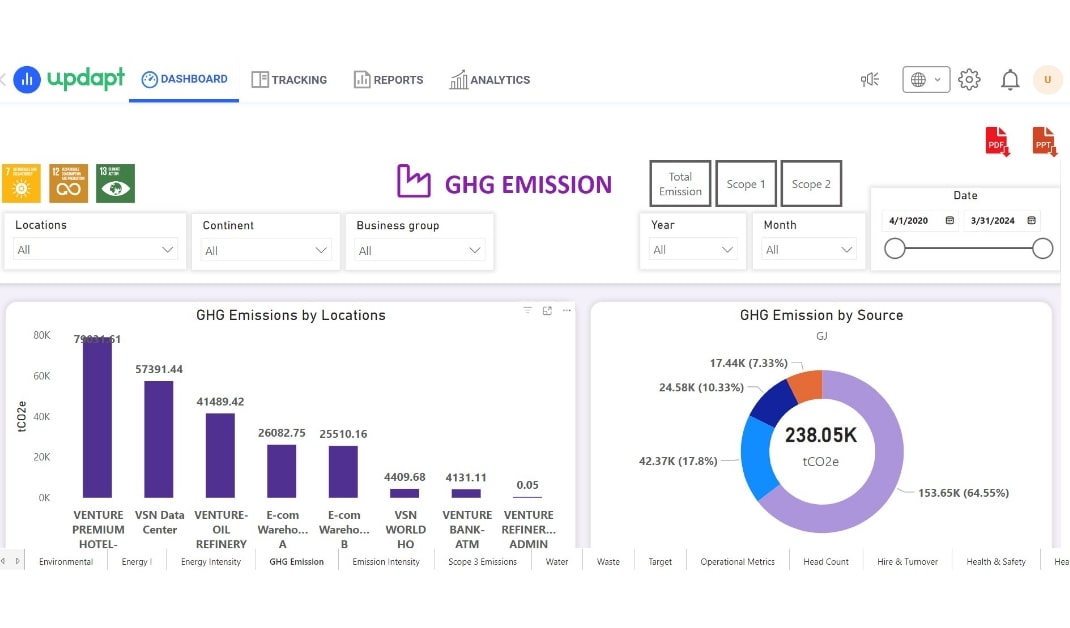

Users can measure scope-1, scope-2 and scope-3 emissions separately and it has a wide range of emission reduction strategies.

- Location based carbon emission tracking.

- Offset emission through various decarbonisation projects.

Whereas, it provides various solutions and suggestions to reduce carbon emission.

- Enhanced Portfolio Due Diligence for Sustainable Investments.

- Proactively managing ESG Risks with Comprehensive Assessments.

- Comparing Portfolio's ESG Performance.

What are the frameworks commonly used in real estate?

- TCFD- Task Force on Climate related financial disclosure.

- CRREM- carbon risk real estate monitor.

- Carbon Disclosure Project - Carbon Disclosure.

- GRESB - Global Real Estate Sustainability Benchmark.

- SFDR- sustainable finance disclosure regulation.

- GRI- Global Reporting Initiative.

- SBTI- Science Based Targets initiative.

- ISSB- Sustainability Disclosure Standards.

Buyers Guide : ESG Reporting Software for Sustainable Real Estate Investors

ESG investment assets value has gotten more prominent this year as compared to the previous ones. So, investors keep seeking out organizations who practice ESG as per their convenience. Whereas, many investors incorporate ESG factors into their investment process for better decision making.

Decision making is deeply connected with ESG data. ESG data cannot be managed manually. Therefore, investors are looking for ESG reporting software with appropriate features.

As a real estate investor, the expectation from the software are as follows:

- Comprehensively monitor ESG performance across various portfolio

- Portfolio ESG Assessment and improve ESG Performance.

- Portfolio alignment.

- Integration ESG performance into investment decisions.

- Customize the measuring KPI.

- Able to create sustainability strategies for long term value creations.

- Reduce the reporting cost.

- Compliance management and risk management.

- Scenario Analysis.

As an investor, before buying the ESG software we will have to check the above features.

Top Four benefits using ESG software for real estate :

- Cost saving.

- Distinctly identify risk and mitigate the risk.

- Enhance Brand reputation.

- Improve the property values.

Distinctly Identify Risk and Mitigate the Risk:

ESG Software comprehensively understands business behavior and in advance transpires the risk. Whereas, elaborately analyzes factors for risk and provides solutions to mitigate the risk.

Enhance Brand Reputation:

With the help of the software tool users can align the ESG data properly, it paves way for enhanced ESG reporting. Better reporting always leads to improved transparency. Through the software, real estate industries can also showcase their sustainability practices. This type of activity leads to gaining potential investors as well as improving the brand reputation.

Identify the area where improvisation of the performance is required:

ESG data can precisely identify optimization areas on business operations as well as the ESG data evidently bestows a clear view of the ESG performance.

ESG Software Pricing option in 2024:

Before buying the software should have been checked below for specifications.

Pricing Options: Free Trial for one week or one day, Monthly Subscription and Free Demo Availability.

Integration Support for different types of organizations and multi-level integration.

Aligning to global standards of reporting such as GRI, BRSR, TCFD, CDP and more.

What is ESG for real estate?

ESG is a set of frameworks or rules with which they can evaluate property portfolios.

Benefits of ESG reporting for commercial real estate property:

Gain potential investors:

As mentioned above, ESG investing is gaining importance among the investors. Demonstrating your sustainability responsibilities with investors can gain potential investors easily.

In a nutshell:

We have been facing various environmental challenges across the globe. Many governments comprehend and address those issues as well as have created appropriate enactment. However, according to the environmental circumstances we must adhere to some potential rules for our next generation, our globe.

ESG is among the ones. Therefore, real estate industries should incorporate ESG with their core business and at the same simplify the work using ESG reporting software.