Table of content:

What is Carbon accounting.

What do you mean by carbon accounting?

Carbon accounting with scope 1, scope 2, scope 3.

How does Carbon accounting benefit businesses?

What is the best Carbon Accounting Software?

Best Carbon Accounting Software should possess these features.

Carbon accounting methods.

Carbon accounting challenges.

Carbon accounting frameworks.

FAQ

What is Carbon accounting:

Carbon accounting or green gas accounting is nothing but just measuring what percentage of green gas exit from the organizations business activities.

The primary reason for addressing carbon emission is social responsibility as well as legal requirements.

Carbon emission being reasons for climate change and global warming, so carbon accounting becomes necessary to the business.

Businesses or industries have to submit emission reports each year

Using carbon accounting entities can comprehensively understand where emission comes from and it is used also by governments, various industries for reducing carbon emission.

Whereas with the help ofcarbon accounting, investors precisely will understand the organization's carbon risk before they invest.

Once industry will comprehend emission range, they can effectively create the target towards reducing.

What do you mean by carbon accounting?

Carbon accounting is measuring at what volume of range greenhouse gas emissions released into the atmosphere through entities' business operations.

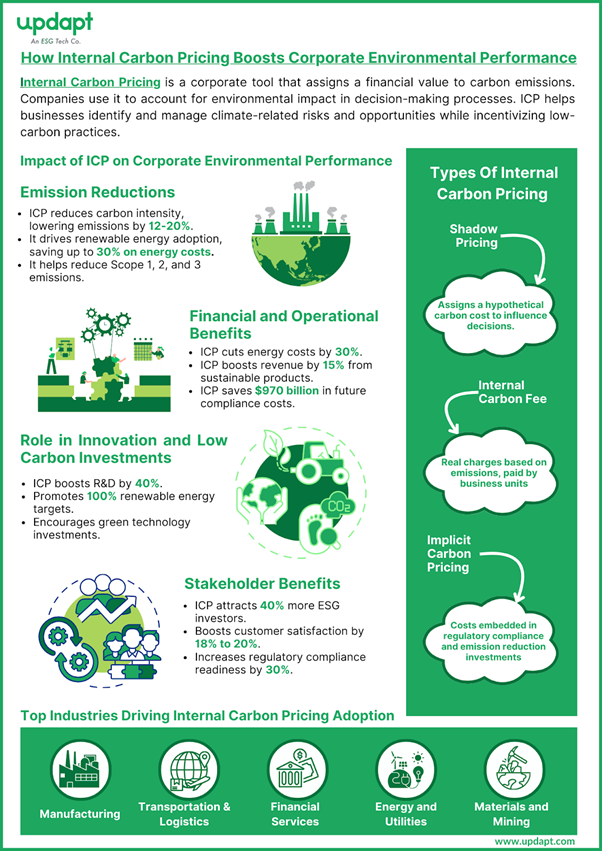

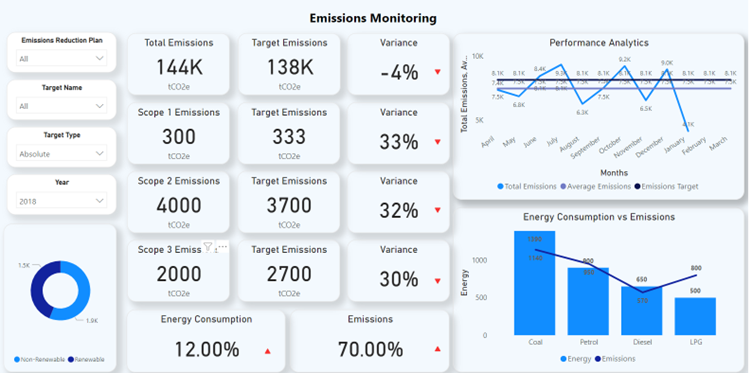

Carbon accounting with scope 1, scope 2, scope 3:

These are:

Scope 1

Scope 2

Scope 3

Scope 1

Scope 1 implies direct emission which means emission is created by organizations.

Organizations might do manufacturing processes that include steel manufacturing, cement production, and more. Through manufacturing emissions are created.

Whereas, emissions are exited through organization controlled assets like organizations vehicles.

Scope 2

Scope 2 implies indirect emission which means emission is created by organizations purchasing energy.

These greenhouse gasses emission not emanating from organization but organization associate with take place of emission

Scope 3

Scope 3 emission implies indirect emission which means not directly controlled by entities but it generated through entities activities.

How does Carbon accounting benefit businesses?

Carbon accounting bestows various benefits to organizations, governments along with providing a vivid structural approach to measure, manage and reduce carbon emission.

Risk management:

Carbon accounting helps entities to evaluate and identify climate risk that includes market risk, reputational risk and regulatory risk.

If there is any climate risk in business operation and supply chain, using carbon accounting can develop appropriate risk mitigation strategies.

Able to improve brand value and reputation:

Business landscape moves into zero carbon emission.

Strong carbon accounting efforts Differentiating your organization from other organizations.

Consumers, product seeking owners are considering carbon accounting as a purchasing decision, so those who want to implement strong carbon reduction that potentially improve brand values . It not only purchases decisions but also attracts the customers and paves the way for selling their product with premium price.

Cost saving:

Tracking the carbon emission makes a significant advantage on energy saving that leads to cost saving. Carbon accounting provides you a comprehensive view of organizations inefficiency in business operation of transportation, production and supply chain.

Through precisely identifying inefficiency areas that lead to avert unnecessary energy consumptions, and carbon emission.

Overall

Effortlessly achieve netzero goals:

Carbon accounting with reporting provides you emission information that includes indirect and direct emissions. With Help of the clear picture about emission can make necessary changes and reduce the emission and achieve climate change goals Effortlessly.

Regulatory compliance:

Across the many countries measuring carbon emission becomes necessary to businesses. Whereas, based on geography regulation will change frequently each year. So, carbon accounting and reporting helps businesses to comply with these regulations.

Attract the potential investor:

Investors are analyzing the organization's ESG performance through carbon accounting with reporting which helps investors to make decisions before investing in ESG stock.

Preparation for future market:

Across the globe countries have been implementing net zero for businesses. Whereas, investors, consumers, and industries are insisting and prioritizing Sustainability and ESG. so, prepare an ESG portfolio for the future market.

What is the best Carbon Accounting Software?

Carbon accounting software helps entities to track, manage and calculate greenhouse gas emissions. Whereas, it simplifies data collection & management and improves ESG performance through ESG reporting.

The best carbon accounting software should effectively manage organization carbon emissions and provide detailed solutions to decarbonizations. Furthermore, it should provide a comprehensive ESG solution based on industries.

To meet international regulatory compliance in ESG reporting, two frameworks are necessary.

Best Carbon Accounting Software should possess these features.

There are various carbon accounting software in the market but among them, updapt carbon accounting software is different and unique.

However,

Data collections:

How do you align ESG data, if each data format is different?

How do you ensure data is quality?

Can software manage large volume data?

Software should possess features such as data quality ensure, manage large volume data and data normalization.

ESG reporting with framework:

ESG reporting is necessary forScope emission management:

One of the complex processes is measuring the scope emission.

Scope 1 emission represents direct emission, scope 2 emission represents indirect emission from energy, and scope 3 emission represents indirect emission from the value chain.

Moreover,

Decarbonization actions:

Risk management:

What are Other features software should possess?

Carbon Accounting Methods

Spend based method:

Spend based emission methods evaluate green gas emission from organizations financial spending of goods and services.

How it works:

Spending information:

Organization should assortment data expenditure of various categories that include transportation, raw material, etc.

Emission calculation:

To calculate emissions, multiplied by the respective emission factor is the total amount spent in each category.

Advantage:

Without numerous data gathering, it is easy to evaluate the emission because organizations already track financial expenditure.

Demetris:

This method doesn’t provide detailed insights into emissions sources and at the same time less accuracy is another obstacle.

Activity based carbon accounting methodology:

It method implies measuring the green gas emission through actual data such as transportation, water use, energy use and ect.

Compared to the Spend method, it processes a more accurate and detailed approach for emission measuring.

Metris:

With the help of comprehensive data, entities easily can develop targeted mitigation strategies. Whereas, this method helps to identify emission areas through sources.

Demetris:

It requires various data that may be in various resources and at the same time it is difficult when it comes to multi-operation organization.

Data accuracy is deemed another Demetris of Activity based carbon accounting methodology.

Hybrid method:

Combination of spend and activity method is a hybrid carbon accounting methodology.

If Entities have direct data measuring carbon emission through Activity based, if they do not have direct data then move to the Spend method.

How it works:

Entities apply when an organization has an accurate data activity method, if they do not have data apply the spend method.

Metris:

It improves the accuracy and at the same time easily measures scope 3 emission.

Demetris:

Data management is complex.

GHG protocol.

Commonly used by various organizations, its emissions are divided into three types then measure the green gas emission.

Carbon accounting challenges:

In today's modern business, measuring green gas emission has become necessary. Even Though if it is necessary, it has some challenges in carbon accounting.

These are:

Data collection with accuracy:

Measuring carbon emission requires various data such as Waste Generation data, Transportation Data, Employee Commuting Data, scope data, etc.

Therefore, align data based on format and consolidate are more complex.

Measuring emission is intricate, especially scope 3:

Each industry's business operations are different, based on the type of industry that has various business operation

So, tracking of contributing emission sources is complex and at the same time it is more complex when it comes, especially scope 3 emission.

Reporting requirement with standardizations:

Based on geography, the reporting requirement is different. Moreover, various methodologies and frameworks pave the way for confusions.

Data accuracy:

Ensuring data accuracy and credibility is the primary process in carbon accounting. In carbon accounting need to be collected more granular data

List Out Carbon accounting frameworks

- Green gas protocol.

- Carbon disclosure project.

- Global reporting initiative.

- Task force on climate related financial disclosure.

- Science based target initiative.

Types of Carbon Accounting:

- Project based carbon accounting.

- Supply chain carbon accounting.

- Financial carbon accounting.

- Organization carbon accounting.

Carbon Accounting Standards:

- GHG Protocol Corporate Standard.

- ISO 14064.

- Carbon Disclosure Project) Reporting Framework.

- ISO 14067.

- PAS 2050.

- Verified Carbon Standard.

- Clean Development Mechanism.

- Partnership for Carbon Accounting Financials.

- Climate Action Reserve.

- American Carbon Registry.

- EU Emissions Trading System (EU ETS).

- California Cap-and-Trade Program.

- China’s National ETS (Emissions Trading System)

- UAE Climate-Related Disclosure Standards

- SEC Climate Disclosure Rule (U.S.)

- Partnership for Carbon Accounting Financials (PCAF)

How does carbon accounting work?

Collection ESG Data:

Data need to be collected from different emission sources, be they direct or indirect emissions. It can refer to other ways, such as owned sources, purchased electricity, supply chain, or employee travel.

Identifying emission sources:

ESG Team should identify In the organisation's business operations which area greenhouse gas emissions are leaking.

Carbon emissions are categorised into three types.

- Scope-1

- Scope-2

- Scope-3

So, each scope emission consists of different types of emissions. The ESG team should identify which type of emission leakage along with the emission source.

After the identification of the emission source and the consolidation of the required ESG data move toward carbon emission calculation.

Carbon Emission Calculation:

Emission sources are multiple by esg data.

Set the target for reduction:

Once emission sources are identified, with calculation, organisations should move forward for the emission reduction goal and set the target for reduction. So, in this way carbon accounting is working.

Why is carbon accounting important in business?

Organisations need to achieve climate goals with regulatory requirements. Whereas carbon accounting immensely helps to reduce greenhouse gas emissions in business operations.

- To enhance ESG reporting

- Improve brand reputation

- Long-term financial saving

- To attract the potential investors

- Better risk management

What is meant by carbon credit accounting?

Carbon credit accounting is nothing but reducing the greenhouse gas emission from the atmosphere. Through carbon credits, organisations can reduce the emissions that they have generated.

1 carbon credit = 1 ton of CO₂

To sum up:

By adopting carbon accounting not only for climate change, it also enhances organizations reputations and easily obtains potential investors.

FAQ: